Merchandise trade posts strong growth in Q1

Jul 18, 2025

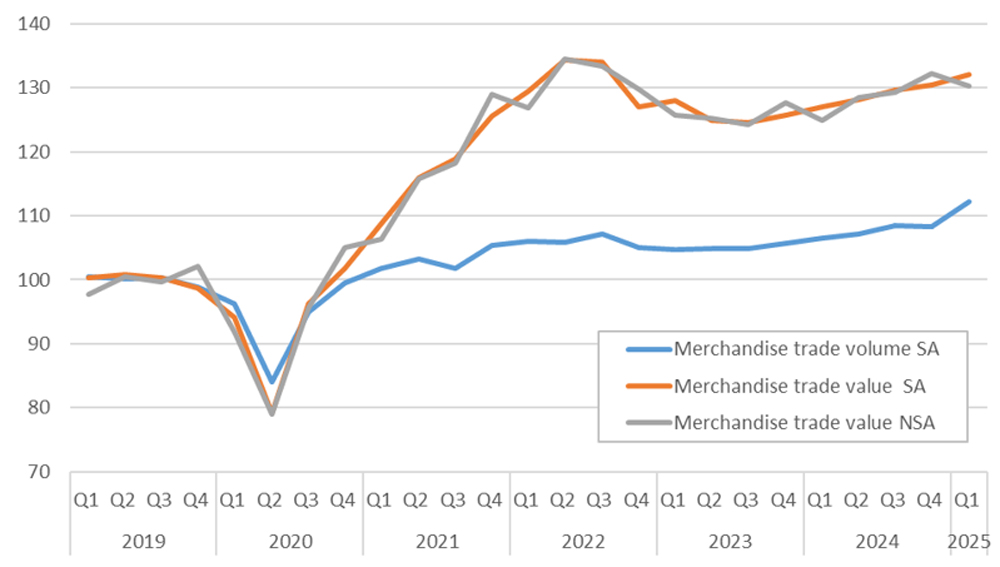

The volume of world merchandise trade rose 3.6% quarter-on-quarter and 5.3% year-on-year in the first quarter of 2025 as imports surged in North America in anticipation of higher tariffs in the United States, latest WTO data show. Merchandise trade volume growth in the first quarter was stronger than the WTO’s most recent forecast, but WTO economists expect the pace of expansion to slow later in the year as fully stocked inventories and higher tariffs weigh on import demand.

The new tariffs announced by the United States on 2 April at the start of the second quarter were widely anticipated, allowing importers to move purchases forward to avoid paying higher duties at a later date. Trade volume growth in the first quarter was above projections issued in the WTO’s Global Trade Outlook and Statistics report on 16 April, both for the Secretariat’s baseline forecast of 2.7% for 2025, which assumed a continuation of policies in place at the start of the year, and the adjusted forecast of ‑0.2% assuming policies in place on 16 April.

Since then, a variety of trade agreements and trade measures have nudged the adjusted forecast up and down slightly, but as of mid-June merchandise trade growth for the year was still expected to be basically flat at 0.1%.

Meanwhile, the US dollar value of world merchandise trade — as measured by non-seasonally-adjusted exports — was up 4% year-on-year in the first quarter of 2025, reflecting strong growth in volume terms and declining prices (Chart 1). The value of trade in the first quarter was down compared to the previous quarter due to regular seasonal variation, but seasonally-adjusted figures continued to rise.

There were significant disparities across regions in merchandise trade volume growth in the first quarter, especially on the import side (Chart 2). North America recorded the strongest quarter-on-quarter import growth of any region by far at 13.4%, followed by Africa at 5.1%, South and Central America and the Caribbean at 3.6%, the Middle East at 3.0%, Europe at 1.3%, and Asia at 1.1%. The Commonwealth of Independent States (CIS), including certain associate and former member states, was the only region to record a decline in the first quarter at -0.5%. On the export side, the Middle East recorded the strongest quarter-on-quarter growth at 6.3%, followed by Asia at 5.6%, South America at 3.2%, Africa at 2.5%, Europe at 1.9% and North America at 1.8%. The CIS region also registered an export decline of -1.0% in the first quarter, said a release.

Please visit our youtube channel https://www.youtube.com/@ikargos2719 for fortnightly logistics news analysis and more!