Global merchandise trade beats expectations in first half, but 2026 projection lowered

Oct 9, 2025

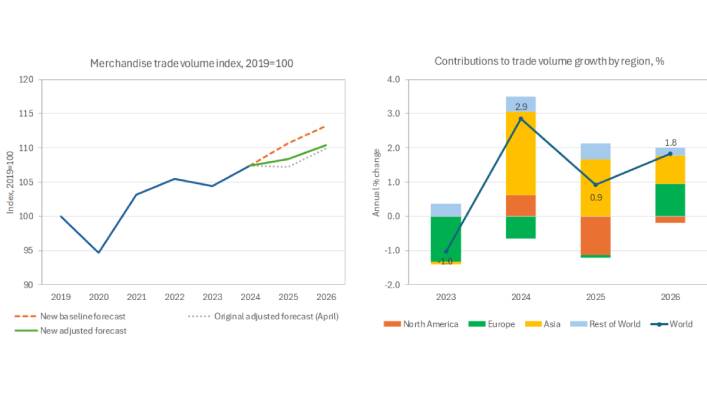

Global merchandise trade outpaced expectations in the first half of 2025, driven by increased spending on AI-related products, a surge in North American imports ahead of tariff hikes, and strong trade among the rest of the world. In response, World Trade Organization (WTO) economists raised the 2025 merchandise trade growth forecast to 2.4% (up from 0.9% in August). However, the 2026 projection has been lowered to 0.5% (from 1.8%). Global services exports growth is expected to slow from 6.8% in 2024 to 4.6% in 2025 and 4.4% in 2026.

In the October 7 update of “Global Trade Outlook and Statistics”, WTO economists provide new analysis on the build-up in inventories in 2025 and the robust trade in artificial intelligence-related goods such as semiconductors, servers and telecommunications equipment. They note however that trade growth will likely slow in 2026 as the impact of the cooling global economy and new tariffs set in.

Director-General Ngozi Okonjo-Iweala said: “Countries’ measured response to tariff changes in general, the growth potential of AI, as well as increased trade among the rest of the world--particularly among emerging economies--helped ease trade setbacks in 2025,” noting that South-South trade grew 8% year-on-year, in value terms, in the first half of 2025, compared to 6% for world trade overall. South-South trade involving partners other than China is growing even faster, up around 9%.

Growth drivers in the first half of 2025

The volume of world merchandise trade, as measured by the average of exports and imports, grew 4.9% year-on-year in the first half of 2025. The value of world merchandise trade in current US dollar terms was up 6% year-on-year in the first six months of 2025 following a 2% increase in 2024.

Trade growth drivers in the first half included the frontloading of imports in North America and favourable macroeconomic conditions such as disinflation, supportive fiscal policies and strong growth in emerging markets. Industry reports, including purchasing managers’ indices (PMIs) and national statistics, show rising inventories, with inventories-to-sales ratios in North America increasing in the first half of 2025 across sectors like machinery, motor vehicles, lumber, construction equipment and non-durable goods.

AI-related goods - including semiconductors, servers and telecommunications equipment - drove nearly half of the overall trade expansion in the first half of the year, rising 20% year-on-year in value terms. Trade growth spanned the digital value chain, from raw silicon and specialty gases to devices powering cloud platforms and AI applications. Asia’s export performance was strong in AI-related products, consistent with the worldwide surge in investment in this sector, said a release.

Please visit our youtube channel https://www.youtube.com/@ikargos2719 for fortnightly logistics news analysis and more!